Table of Contents

What are Variable Costs?

Variable costs (CV) are those that vary when the level of activity of the company changes. It is the opposite of fixed costs.

Example: the cost of inputs that, when production is zero, the cost of inputs will also be zero; if production increases, the cost of inputs will also increase, and if production decreases, the cost of information will also decrease.

Unit of Variable Costs

The unit variable costs (CVu) is the one that corresponds to a production/sale unit. For example, the cost of the raw materials used to make a pair of pants is S / 35.00 per unit.

Importance of Variable Costs

It allows companies or businesses to have better control over accounting. Therefore, it is necessary to keep a record of expenses since they are the basis for making the company’s appropriate economic decisions internally. At the business level, variable costs use to:

- The company must determine an appropriate level in the price of the products.

- Make calculations of percentages that give benefits and profitability to both the company and the product.

- Promote attractive discounts depending on your cost levels.

- Businesses should think about the possibility of an impact in case some of the payments go up.

- Make wise changes in raw materials or input suppliers.

- Have full knowledge of the company’s expenses.

- Cost control is essential through variable cost control.

How can Variable Costs be Calculated?

- It makes the calculations of it.

- A table must make where you know the price of a particular product or the raw material needed to produce it and thus increase the number of units going to make or buy.

- If you have different amounts of variable costs, it is necessary to add up the totality of all these costs and thus be able to know the total of said cost.

- It is imperative to note that the higher the production or sale, the greater it.

- In this sense, it will be necessary to incorporate a fundamental piece of information negotiating with the suppliers. Generally, if the purchase is more significant, the product must be less expensive.

- It means that the company must exercise caution when calculating it.

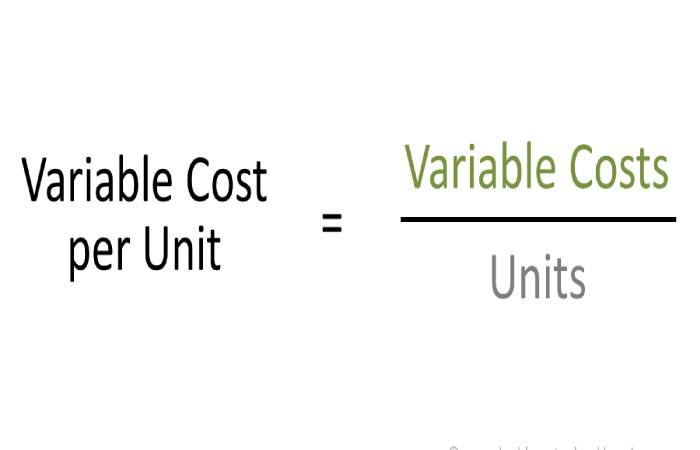

The formula to calculate:

- Total variable costs = Unit variable cost * Total units produced.

Where:

- Unit Variable Costs (CVu) is the variable cost of producing a unit.

- For example, a beverage factory takes $ 3000 in raw materials and $ 4000 in labor to produce 150 units—drink cans. The ongoing fixed costs are $ 3000.

What are the Types of Variable Costs?

It can be proportional, progressive, or regressive.

1. Proportional

Those costs are strictly linear to the activity. These vary according to the volume of what produce.

Example: materials needed to produce a particular product.

2. Progressive

Those costs vary in proportion to what they produce.

Example: labor; the more they produce, the more hours employees pay.

3. Regressive

Those inverse costs at the production level. The more production, the less price.

Example: purchase of materials in a wholesale way, with a quantity discount.

Examples of Variable Costs

Here are some examples:

Manpower: the more demand there is in a company, the more personnel it will need.

Materials: The more demand for a product, the more raw material will need.

Selective taxes: Taxes on luxury items, alcoholic beverages, or banking services.

Product packaging: Your cost will depend on the amount of product that sells.

Commissions on sales: The employee’s salary depends directly on the number of sales he makes.

Characteristics of Variable Costs

The characteristics of the variable cost are:

- If the production of articles, goods, or services cancel, the variable costs disappear.

- The number of variable costs will tend to be proportional to the number of goods produced.

- It does not depend on time but has already been emphasized on its volume of business.

- This type of expense can control and manage in the short term.

- It is regulated and classified by the entity’s administration department.

Conclusion

It can help check the financial results by offering accurate information on the business’s behavior.

If production activity increases, this type of expense will also increase, and, vice versa, if it decreases or falls, the variable cost will respond similarly.