Table of Contents

What is the Stock Market?

The Stock Market has greater security, profitability, liquidity, and flexibility than any other asset.

Therefore, investing in the Stock Market is interesting for all the public since it is very profitable in the long term; also, it gives more excellent stability through dividends.

What are the Advantages of the Stock Market?

Before investing in the stock market from scratch, we must know the benefits and risks of investing in the stock market. Let’s start with the advantages:

1. Periodic Income

- It is a significant advantage since the securities portfolio that we believe will generate income from dividends on the shares.

- And also, it should tolerate in mind that the money obtains by collecting dividends.

- It can reinvest in buying more shares or used for their consumption, depending on each investor’s needs.

2. Low Commissions

- They are low if we compare them with those of other assets such as investment funds or expenses of investing in a property.

- But of course, we must tolerate in mind that they charge every year or per operation.

- It depends on the broker we use for carrying out operations. Therefore we will have to inform ourselves very well of the broker’s commissions before operating on the stock market.

3. Total Freedom to Invest

- We have no obligation to buy or sell if we do not see that it is time to do so. That is, we are the owners of our movements at all times.

4. Diligent to Decide to Enter or Exit

- We can enter or exit the market at any time. Our positions do not influence compared to the size of the market.

5. Investing in Securities

- We have the possibility of investing in outstanding companies that do not meet the requirements for size or liquidity to belong to an index. These companies tend to have higher profitability.

- One thing to keep in mind is that companies that meet the volume of capitalization and liquidity requirements enter into indices, but their fundamental analyses are unfavorable.

- I recommend that a company belongs to an index does not mean that we should invest since not all are solid and profitable.

6. Dividends Paid

- We must be aware that dividends paid by companies not reflect in stock indices.

- As long as a person is thorough and saver, the returns obtained by investing in the stock market may be useful and stable.

- It more than in any other investment, despite what the vast majority think, only that you have to learn some simple guidelines without need to have prior knowledge.

What are the Risks of Investing in the Stock Market?

- Just as I have highlighted its advantages, we must also consider the risks we face when investing.

- To our ignorance, when we begin to be interested in the stock market, we must add the breadth of terms, analysis, “experts,” needs, and products that exist.

- Before investing, we must consider market risks (derived from our acquisitions’ loss of value due to volatility).

- The company’s risks or sector in which we would be interested in investing (liquidity risks or not systematic).

- If you are interested in knowing them in-depth, I recommend that you read the stock market risks.

- The most important thing is that you read, train, and analyze and know the sector and the companies for yourself to avoid these risks. It is also important to read stock message boards to get other investors’ opinions.

Guidelines to follow to Start Investing in the Stock Market

We know that the future in anyone’s economy is determined by:

- The money you earn

- The money you save

- And also, the money you invest.

We are incorrect when we think that the idea of getting rich is to earn a lot of money.

We get rich when we save; just by making money, you don’t get rich; As the saying goes, it is not the one who earns the most but needs the least.

Although we earn a lot if we devote it all, we do not get rich either. Therefore we must know how to save and invest those savings in creating more wealth.

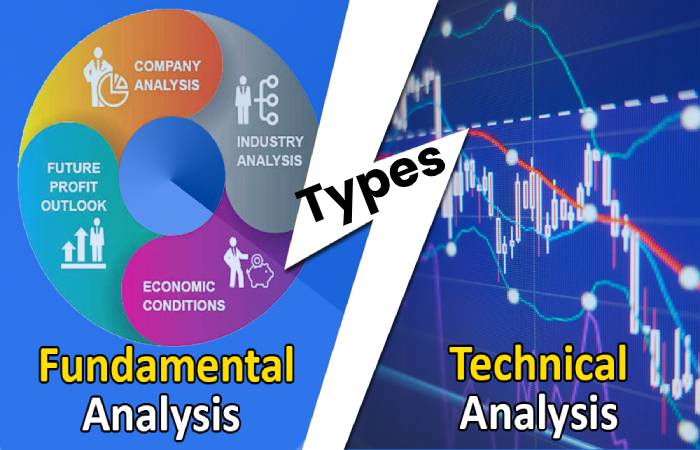

What are the Types of Stock Market Analysis?

1. Fundamental Analysis

The fundamental analysis is to determine the value of companies based on their results and assets held. How? With a series of metrics:

PER: Relates the market capitalization of a company with its net profit, that is, its earnings with its price per share. It tells us how many exercises are essential to generate profits to be equal to their market capitalization.

Price / Cash Flow: ratio used to compare a company’s market value with its cash flow. The lower the rate, the better its value.

Price / Book Value: measures the relationship between the price at which the shares trades and the value of their equity, that is, the book value of their assets less the book value of their debts. The price at which it lists is lower than its book value, and therefore we would be facing a buying opportunity.

The company is trading at a price that is approximate to its book value. The price at which its list is higher than its book value.

ROE: measures the return obtained by the shareholders of the company’s funds, its ability to reimburse its shareholders.

Net Dividend per Share: The amount of net profit achieved by a company divided or distributed among the number of shares.

Profitability per Dividend: It measures the fraction of the share price that goes to shareholders in the form of a dividend each year.

Net Profit (Millions): The profit remains in the company after covering all expenses and taxes.

Ebitda (Millions): is the gross working profit calculated before the deductibility of expenses.

EPS: is the part of the profit that corresponds to each share of a company. It indicates the profitability of the company.

In the stock market blog from scratch, you can know all the details. If you are especially interested in companies’ valuation, you can learn more about the Valuation of companies: PER, EBITDA, cash flow, sales, capitalization.

2. Technical Analysis

In the technical analysis, you have to look at the quotes’ charts, the evolution of their price, and do not consider its results or assets.

It always advises using 2 or 3 indicators so as not to lose focus of the analysis.

Our broker’s platforms usually provide these programs (in some cases, they can delay). It would be suitable if they were in real-time.

Trend Indicators

- Weighted Moving Average use to identify the start of trends, their monitoring, and the detection of their exhaustion.

- Its interpretation in general terms is that if the price moves above the MMP, the MMP has a bullish direction (positive slope), it can consider a signal of strength (buy).

- If the price moves below the MMP, the MMP has a bearish direction (negative slope), it can be considered a signal of weakness (sell).

- Valid buy and sell signals do not occur when the MMP changes direction only, but the price moves above or below the MMP.

Volume Indicator

- It indicates the number of securities traded in a chosen period (intraday, day, week). According to the DOW theory, the volume must accompany the trend.

- The magnitude of the work is indicative of the consistency of the movement.

Relative Strength Oscillator

- RSI measures the strength of the price.

- The RSI oscillates in various 0 to 100 indicate the overbought zones (from 70-80 to 100) and oversold (30-20 to 0).

- It means the upward trend when it approaches 100 and indicates a downward direction when it comes 0.

- In practice, buy signals typically produce when the 30 floors cross and sell signals when the ceiling cross 70.

Discussion Between Fundamental and Technical Analysis

- The discussion between technical and fundamental analysis is a bit complex. Analysts think that only the fundamental one needs to do and others the technical one.

- My personal opinion is that you have to do both the fundamental analysis. It tells us the company’s situation and the technician because it gives us the input and output signal.

- When we have invested in a security, it is vital to keep track of its quarterly results.

- When I talked about strategy in the previous point, I was also referring to forming a solid securities portfolio.

- That is, they have benefits that grow in the long term.

For this it would be convenient:

Diversify Assets

It is unnecessary to have considerable assets to invest in several companies, so it is advisable to diversify both companies, sectors to minimize risk.

Diversify Temporarily

You can temporarily invest in a company, that is, you decide the time you want, or it is convenient for you, for days, months, years, in a way that allows us to avoid the risk of a sharp decline.

Liquidity

We can have the liquidity of the investment when we need it. It is also essential to keep in mind that owning shares in a reliable company can obtain a loan.

Transparency

We will find many web pages on the internet that provide us with free information on the quotation, dividends, fundamental and technical information of any company. Thanks to these transparencies, we can know the listing price of our shares.

Profitability

Profitability depends on the growth of profits and dividends of the companies.

Security

The profits obtained by the transfer of the shares and the dividend directly enter into our account.

What is the Stock Market Time?

The stock market time is:

Opening auction 8.30 am to 9 am (+30 “)

Open market 9 am to 3:30 pm.

Closing auction 3.30 to 3.35 (+30 “)

At the opening auction from 8.30 am to 9 am, orders can be entered, modified, and canceled, but the order book is not yet available without crossing trades.

The chance end of the auction (30″), within 30 seconds, ends without warning. It serves to avoid price manipulations.

The continuous constricting market is open from 9 a.m. (after 30″) until 3.30pm.

In the closing auction, the same thing happens. The 5-minute time slot is from 3:30 pm to 3:30 pm and will also end with a random end of the auction of 30”.

I leave you an article about the opening and closing auctions that may interest you to expand the topic.