Table of Contents

What is the Leverage Ratio?

The leverage ratio is a measure that relates the indebtedness and the assets of a company, easy to calculate, and whose homogeneity allows the comparison between entities.

It is a lesson that comes after the financial crisis. Financial institutions cannot generate capital based solely on the risk they take. It does not guarantee their survival.

There must be a magnitude that measures the quality of said capital and its real capacity to absorb losses.

How does the Leverage Ratio Arise?

One of the causes of the new global financial crisis has been the financial sector’s excessive indebtedness. In other words, the relationship between the financing a bank needs to grant loans to its clients and its capital.

The amount of money that a financial institution obtains from its creditors for each euro of its worth. Let us remember that a bank finances its assets (loans granted) through its resources (capital) and its onerous liabilities (debt and deposits).

Therefore, one way to control your indebtedness would be to require more capital to finance the asset.

1. Results

- BBVA earns € 709 million in the first quarter.

2. Revenues

- Gross margin amounted to 5,788 million euros (+ 14.9% year-on-year in constant rates) thanks to the strength of recurring income (interest margin plus commissions).

3. Risks

- The Group’s NPL ratio improves to 5.3% at the end of the quarter, compared to 5.4% in December; coverage remains stable at 74%.

4. Capital

- And also, BBVA reaches a fully-loaded CET1 ratio of 10.54%, with growth in the quarter of 21 basis points.

5. Transformation

- At the end of the quarter, the BBVA Group’s digital customers reached 15.5 million (+ 20% in the last year). Of these, 9.4 million are mobile customers (+ 45%).

- However, pre-crisis regulation considers measuring the financial health of an entity. It was enough for it to maintain a certain percentage of its capital based on its risk-weighted assets (APRs) ( ‘The flash’: Ratio of What is the capital of a bank and how it calculate? ) considering as a variable how the indebted said entity was.

- Later, the crisis showed that the capital required through these ratios was not enough to absorb potential losses. And also, the combination of the different risk valuation models permissible banks to reach very low APRs.

- Thus, many entities had very high capital ratios, not because they had sufficient capital, but because the denominator (APRs) did not reflect the risk incorporated into their balance sheets.

- It also allowed them to borrow excessively without alarm bells raise until the crisis reached an extreme.

- They force to carry out very aggressive deleveraging processes that generated a vicious cycle of losses, a fall in the capital, and a credit reduction.

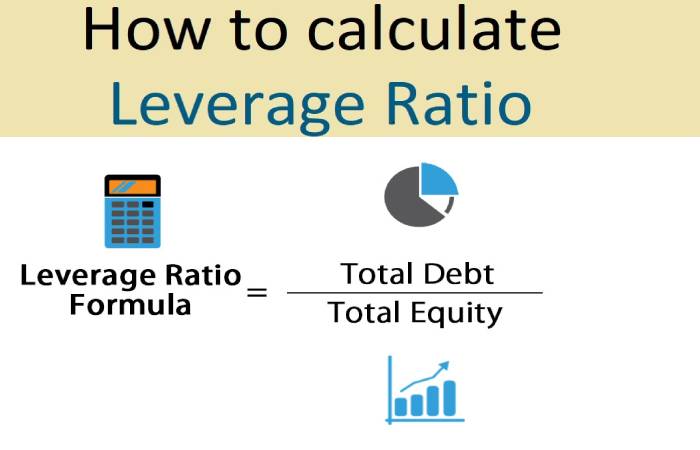

How to Calculate Leverage Ratio?

In this environment, the Basel III Committee considered it appropriate to introduce a magnitude complementary to traditional capital ratios and measure an entity’s capital quality.

The leverage ratio emerged, whose calculation is simple, transparent, and comparable between different entities. The European Commission also adopted in October 2015 the definition of the leverage ratio in line with the Basel standards.

The leverage ratio is the ratio of the required Tier 1 (or CET1) regulatory capital to total bank assets (including those that are off-balance-sheet). With this ratio, the controller aims to achieve two objectives:

- On the one hand, limit the excess debt that an entity can assume.

- And also, have a complementary measure that reinforces capital requirements regardless of risk.

- Among the advantages, this ratio (also already mentioned associated with the simplicity of calculation and comparability) covers all risks.

- It also limits the risk that a bank can take regardless of whether its assets’ weight is carried out correctly and prevents the uncontrolled growth of assets on a balance sheet.

The combination of the leverage ratio with the risk-weighted capital ratios generate benefits that may be key to avoiding future financial crises:

- It allows the reduction of systemic risk, ensures coverage of all the chances of an entity, and reduces a bank’s autonomy when carrying out excessive risk activities.

- Thus, those entities with high risk-weighted asset levels restrict raising capital to meet regulatory requirements, while the leverage ratio will constrain those with low APRs.

1. Operating Leverage Ratio

- The operating leverage ratio measures the ratio of a business’s contribution margin to its net operating income.

- It evaluates how much a business’ income changes relative to changes in sales.

- It calculates using the following formula: Operating Leverage Ratio = % change in EBIT (earnings before interest and taxes) / % change in sales.

2. Net Leverage Ratio

- The net leverage ratio of net debt to EBITDA (earnings before interest, taxes, depreciation, and amortization) measures the rate of a business’ obligation to earnings.

- It reflects how long it would take a business to pay back its debt if debt and EBITDA were constant.

- It calculates using the following formula: Net Leverage Ratio = (Net Debt – Cash Holdings) / EBITDA.

3. Debt to Equity Ratio

- The debt to equity ratio measures the ratio of a business’ total liabilities to its stockholders’ equity.

- It offers an at-a-glance look at the value of a business relative to its debts.

- It calculates using the following formula: Debt to Equity Ratio = Liabilities / Stockholders’ Equity

What Leverage Ratio do Regulators Require?

Basel III has established, for 2018, a minimum leverage ratio of 3%, which means that the capital must be sufficient to cover 3% of total assets.

In December 2015, BBVA published a fully-loaded leverage ratio (that is, it incorporates the regulator’s requirements for 2018 although with present data) of 6.0%, the highest in its group of peers.

And also, the sector average was, as of September 2015, at 4.5%.