Table of Contents

What is Finance?

Finance is an area of economics and business administration that dedicate to the study of obtaining capital resources (that is, financing ).

And the transactions that involve investment and savings, considering the risk and uncertainty that this entails. It implies.

Therefore, these resources (money and other forms of assets) are known as financial resources.

Concept of Finance

Financial studies are interested in money management due to different economic agents (the State, companies, or individuals).

It can manage their resources better, betting on their multiplication and the fulfillment of their corresponding objectives.

The world of banking, debt, business investment and the stock market is part of finance’s interest. The formal study of finance divide into two main branches, according to their particular focus:

Corporate Finance

They assume the perspective of who requires funds or assets to invest, who needs to generate resources.

The Valuation of Assets

On the contrary, it assumes the perspective of someone who has the capital to invest and wishes to do so in the most profitable way possible.

In turn, these branches divide into a diverse set of areas of application of financial knowledge.

What are the Characteristics of Finance?

Finance characterize by the following:

- They deal with the management of money and capital goods: banking and savings, investments ( bonds, stocks, etc.), loans, etc.

- As an area of knowledge, finance locates between economics, administration, and accounting.

- It handles vital concepts such as risk, profit, interest rate, investment costs, etc., which describe how the world of money works.

- They also allow the improvement of money management for public and private entities, individuals or families, and large corporations.

- They also rely on other auxiliary disciplines, such as economics, accounting, statistics, and mathematics.

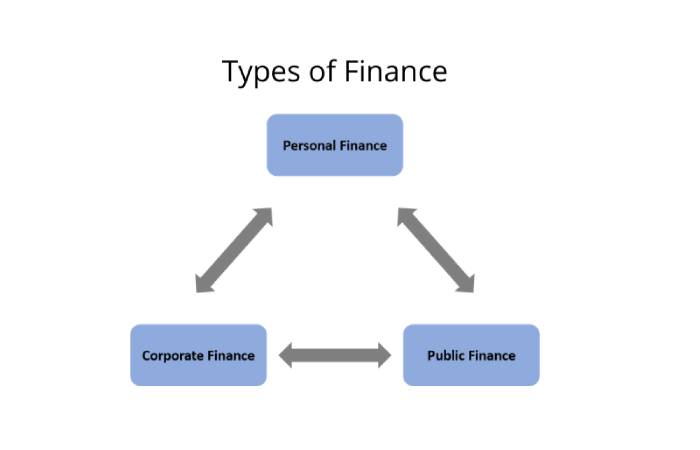

Types of Finance

Finance can classify into two large branches: public finance and private finance, each of which in turn has an essential set of sub-branches or specialties.

1. Private Finance

They seek resource management optimization in private or individual entities: SMEs, large corporations, families, or individuals. They cover the following areas:

Personal Finance

- Those have to do with personal money management: income, fixed expenses, decision-making regarding how to spend the money and on what, etc.

- Personal finance refers to all the resources studied for obtaining and managing families or individuals. Here we go. Here, a financial mandate requires that the personal budget and spend all those monetary resources through time.

- We must consider all those types of risks and financial events that are future in our lives: the administration of all our money, all those income, expenses, insurance, credits, savings funds and investment funds, some material goods, among others.

- To correctly manage personal finances, we must reduce all our debts. It is something quite important if what we want is to start controlling all our finances.

- By eliminating debts, we must have an increase in our savings rate. If we pay all those debts that we have pending, it will be straightforward for us to start saving.

- If you balance all your expenses, you consider very well how to make a type of investment and eliminate all unnecessary costs.

- You will be able to have better financing. Among the areas of personal finance is how to choose a career or profession that is profitable.

- We also have optimal management of the labor income and the indebtedness, and we can also have better decision-making regarding savings and investment.

Family Finance

- Understood as the sum of the finances of individuals who share a home, who jointly face the expenses that this entails, and make joint plans for the future.

2. Corporate Finance

- That they have to do with managing private companies’ or organizations’ assets, financing decisions, investment methods, and managerial decisions.

- When we talk about company finance, we are talking about a study’s focus, obtaining and, of course, administering all those resources that all companies have.

- These are related to a more in-depth analysis of all those variables that allow us to maximize shareholder value, which is why we make decisions that are of a more economical type.

- Thus through different tools, to obtain a simple purpose, and that is to be able to create our capital, acquire some businesses and therefore be able to grow much more click here.

- These comply with stability regarding the company. Regarding its finances, we study all those businesses that can take in a company, thinking about the future when we know what objective the company wants to achieve.

- It can focus on the correct management of the fundamental supports of corporate finance. These are the principle of financing, investment, and remuneration.

- These finances usually study different areas. Among these, we find the projects in which we must invest. They must be productive, and at the moment, we must distribute all our dividends and, finally, the optimal financing options such as business loans and corporate credit card.

3. Public Finance

They involve the State or the public companies that the State manages and, therefore, contain different terms from the private ones. They cover the following areas:

Fiscal policy: How a State collects and administers the taxes it obtains from its citizens.

Public spending: It has to do with how the state invests the money it manages and how much money it injects back into society in the form of jobs, purchases, etc.

Public debt: State cannot cover its expenses and debt with private sectors to keep the State apparatus running.

Budget: That has to do with the projections of future expenses that a State makes, taking into account its financial moment.

4. International Finance

- Finally, we have that study of financial transactions at an international level. These are the famous international finance, and they are also often called global monetary economy.

- It dedicates to the financial economy of economic and macroeconomic interrelationships that make between two or more countries.

- We must know this aspect very well because it is of the utmost importance since it allows the financial executive to understand how all international events can affect the company.

- The correct measures must avoid any risk, and here we will take advantage of all those opportunities that may give us changes in an international environment.

- International finances usually appear when there is a flow of money in the environment in which they move. It usually crosses the border of the national economy and is thus exposed to global economic variables. Here it is crucial to take into account the indebtedness abroad.

- They also consider all those effects of the exchange rate fluctuation for profitability, all capital movements abroad, and finally, all the inseparable risk of investing in any country.

Importance of Finance

- Given the fundamental principle of every economy, the world’s resources are finite, while the needs we must cover with them are infinite.

- Or, put another way: that money is not enough to do or have it all at once, the importance of a field of study such as finance is obvious.

- Finance allows individuals and organizations to play the game of capitalism in the best possible way.

- It obtains the necessary resources at the right time and to be able to keep the economic machinery running.

- Waste, lousy investment, administrative clutter, and poor decisions can lead a productive and useful initiative to its ruin.

- That is why resource management is something that no one today can afford to ignore.

Differences between Finance and Economics

- Simply put, finance is a branch or sector of the vast world of economics. Therefore, both disciplines interrelate and affect each other.

- However, economics has a much broader focus: it studies how human needs can meet through the production methods available to them.

- Finances, seen this way, focus only on what is linked to money. And especially about the industry and the business world.

Conclusion

You must worry about your finance every day, not one day, yes, and one day no. We must consider the prior knowledge we need to understand better the financial world that accompanies us.

Here all those finances analyze from a psychological point of view, more than anything psychological. Here the behavior of people and how they can make a decision represent.

It comes from a union between what is the traditional economy and the new economy. It is why we say that it is a union of psychology.

Also Read: What is E-Commerce? – Benefits, Characteristics, Uses, and More

- KNOW MORE:- safenhealthyl