There are numerous possibilities when it comes to handling online payments. One of the most popular choices is echeck payments. This type of payment allows customers to pay for items or services by transferring money straight from their bank account to the merchant’s account. Here is all you need to know about echeck payment processing.

Table of Contents

What is an echeck, and how does it work?

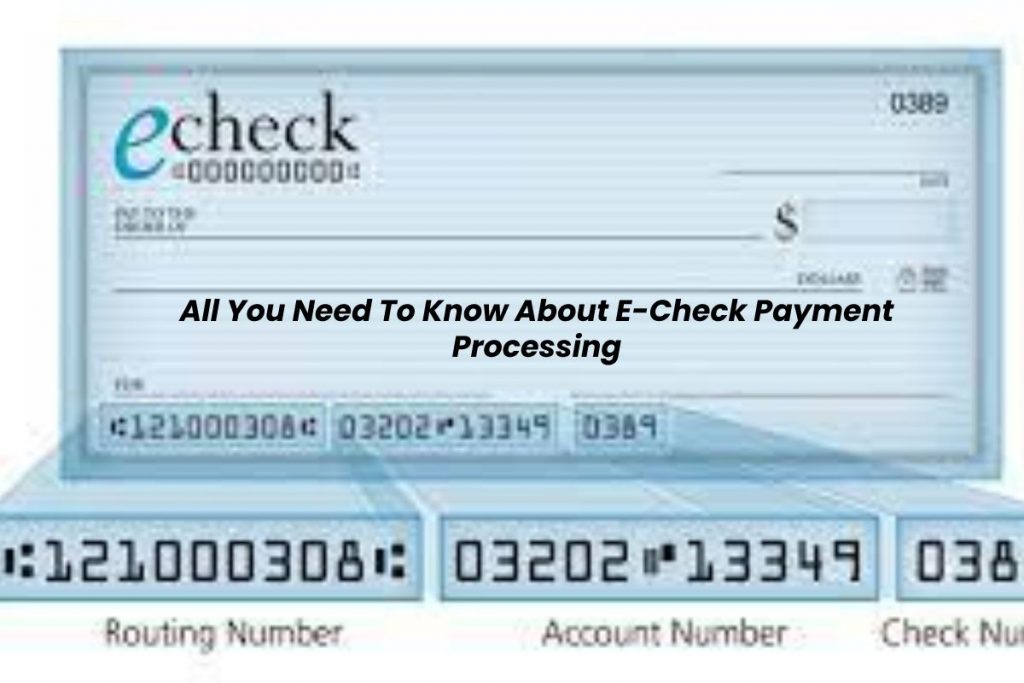

An echeck, an electronic check, is a kind of payment that processes transactions through the Automated Clearing House (ACH) network. Banks and other financial institutions use this network to move money between accounts. When you make an echeck payment, the funds are transferred from your bank account to the merchant’s account using the ACH network.

The benefits of using echecks for businesses

There are numerous advantages for businesses that accept echeck payments. First, echecks are a very efficient way to receive payments. The funds are moved straight from the customer’s bank account to the merchant’s account, so there is no need to wait for a check to clear or for the funds to be deposited into a merchant account. It can save enterprises a significant amount of time.

Another benefit of using echecks is that they can help businesses save money on payment processing fees. Echecks are typically processed lower than credit cards, so businesses can save on transaction fees by accepting echeck payments.

Finally, echecks offer businesses a more secure payment than other methods, such as checks or money orders. Echecks are processed through the ACH network, a secure system that banks and other financial institutions use. Businesses can be confident that their customer’s information is safe and secure when they make an echeck payment.

How to get started with echeck payment processing

If you’re interested in getting started with echeck payment processing, there are a few things you’ll need to do. First, you must open an account with a payment processor that accepts echecks. You can find a list of echeck processors on the National Automated Clearing House Association (NACHA) website.

Once you’ve found a processor, you’ll need to provide them with information about your business, such as your business name and address, bank account information, and taxpayer identification number. You’ll also need to agree to the terms and conditions of the processor.

After you’ve created your account and entered all of the required information, you’ll be able to start accepting echeck payments from your customers. You’ll need to provide your customers with your processor’s routing and account numbers. You can find these numbers on your processor’s website or your monthly statement.

Make sure you’re prepared

Before you start accepting echeck payments, it’s essential to make sure you’re prepared. Be sure to have all of the necessary information about your business and your processor ready before you start taking payments. It will help to guarantee that the procedure runs smoothly and without issues.

If you’re unsure whether echeck payment processing is suitable for your business, it’s a good idea to speak with a representative from a processing company. They can help you understand the benefits and drawbacks of echeck payments and can help you decide if this type of payment is right for your business.

Tips for improving your checkout process with echecks

You can optimize your checkout experience and make it more efficient for your customers by doing a few things. Here are a few tips:

Ensure you have all of your customers’ information before they begin the checkout process. Their names, addresses, phone numbers, and email addresses are included.

Make sure you have a way for your customers to find your routing number and account number easily. You can include this information on your website or your invoice.

Make sure you offer customer support if there are any checkout process problems. It would be excellent if you had someone on hand to answer queries or handle problems.

Frequently asked questions about echecks

Here are a handful of the most often asked echeck payment questions:

How do I set up echeck payment processing for my business?

You’ll need to set up an account with a payment processor that offers echeck payments. You can find a list of echeck processors on the National Automated Clearing House Association (NACHA) website.

What information must I submit to my processor?

When you set up your account, you’ll need to provide your processor with basic information about your business, such as your business name and address, bank account information, and taxpayer identification number.

How do my customers make payments using echecks?

Your customers need to provide your processor with your routing and account numbers. They can find these numbers on your processor’s website or your monthly statement.

Are there any drawbacks to echeck payments?

One potential drawback of echeck payments is that they may take a few days to process. However, this isn’t a problem because most businesses have their money deposited into their account within a few days.

Conclusion

Echeck payment processing is a secure and efficient way to take payments from your customers. It’s essential to ensure you’re prepared before taking echeck payments. Be sure to have all the necessary information about your business and your processor ready before you start. And be sure to offer customer support if there are any checkout process problems. By following these tips, you can ensure that your echeck payment process runs smoothly.